Sub.: Note on Registration of Trade Receivables Discounting System (TReDS)

A) An overview:

TReDS refers to Trade Receivable Discounting System. TReDS is being setup as per the RBI guideline issued on December 3, 2014. It is an online electronic platform and an institutional mechanism for financing / factoring of trade receivables of MSME Sellers against Corporate Buyers, Govt. Departments and PSUs.

The scheme for setting up and operating the institutional mechanism for facilitating the financing of trade receivables of MSMEs from corporate buyers through multiple financiers will be known as Trade Receivables Discounting System (TReDS). The TReDS will facilitate the discounting of both invoices as well as bills of exchange. TReDS support not only invoices raised by MSMEs in the manufacturing sector but also for the service sector as per the MSMED Act, 2006.

TReDS has been introduced with the MCA notification dated 02.11.2018 which mandates all the companies with turnover of more than Rs 500/- Crore to register on TReDS portal.

B) Participants:

| Participants | Eligibility |

| Sellers | MSME entities as per the definition of the Micro, Small and

Medium Enterprises Development Act, 2006 (“MSMED Act”) |

| Buyers | Corporates including companies and other buyers including Government Departments and Public Sector Undertakings and

such other entities as may be permitted by the Reserve Bank of India (RBI) |

| Financiers | Banks, NBFC Factors, Financial Institutions and such other

institutions as may be permitted by RBI from time to time |

C) Eligibility Criteria for MSME Enterprises to Join the TReDS Platform as a seller:

| SR. | Manufacturing and Service sector Investment in Plant and Machinery and Investment in Equipment |

Turnover |

| Micro | Does not exceed Rs.1 crore Rupees. | Does not exceed Rs. 5 Crore Rupees. |

| Small | Does not exceed Rs. 10 crore Rupees. | Does not exceed Rs. 50 Crore Rupees. |

| Medium | Does not exceed Rs. 50 Crore Rupees. | Does not exceed Rs. 250 Crore Rupees. |

D) Documents required for obtaining Registration:

Documents for registration of TReDS is varies as per the applied portal but some of the compulsory documents are as follow:

- Application Form

- Master Agreement

- Bank Confirmation Letter

- Mandate form for debiting the designated bank account (applicable for Financiers and Buyers)

- KYC documents of the applicant entity, promoters, administrator (Admin User), authorized signatories etc.

E) Portal For Registration:

There are three portals on which registration can be made:

- Receivables Exchange of India Ltd. (RXIL) = Mumbai based

- TREDS Ltd. (Invoicemart) = Mumbai based

- Mynd Solutions (M1 Exchange) = Gurgaon based

F) Agreement with the Participants

There would be a one-time agreement drawn up among the participants in the TReDS:

1.Master agreement between the financier and the TReDS, stating the terms and conditions of dealings between both the entities.

2. Master agreement between the buyer corporate and the TReDS, stating the terms and conditions of dealings between both the entities. This agreement should clearly capture the following aspects:

- The buyer’s obligation to pay on the due date once the factoring unit is accepted online.

- No recourse to disputes with respect to quality of goods or otherwise.

- No set offs to be allowed.

3. Master agreement between the MSME sellers and the TReDS, stating the terms and conditions of dealings between both the entities. The agreement should also have a declaration / undertaking by the MSME seller that any finance availed through the TReDS would not be part of existing charge / hypothecation of its Working Capital bankers. An NOC may also be required from the working capital bankers to avoid possibility of double financing.

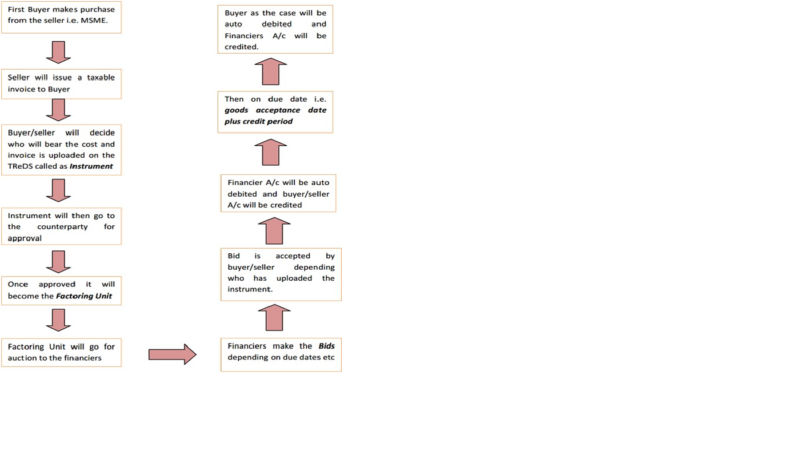

G) How the Process of TReDS Working:

H) Benefits of the Registration to the Seller:

- Best discount rate due to participation of Multiple Financiers in auction.

- Efficient capital deployment.

- Timely receipt of funds.

- Cost & paper work reduction.

- Helpful in Business growth due to improved liquidity.

I) Benefits of the Registration to the Buyer:

- Compliance with MSMED Act,2006.

- Efficient cash flow management.

- Efficient payment cycles.

- Cost & paper work reduction.

PLACE OF RENDERING SERVICES.

The place of rendering services generally shall be our office situated at 2nd Floor, 496/B, Om Apartment, Near KCC Classes, KasbaPeth, Pune – 411 011, Maharashtra, India.

Pramodkumar R. Ladda

Company Secretary & Insolvency Professional

Tel: +91-20-24570055 | Office Cell : +91- 9284293227, 9309845448, 8080051671 |

Personal Mob. : +91- 7972422151, 9595271145 |

Skype id: pramodladda

info@csladda.com | http;//www.csladda.com